mississippi state income tax rate 2021

The previous 882 rate was increased to three graduated rates of 965 103 and 109. In April 2021 New Yorks highest tax rate changed with the passage of the 20212022 budget.

Tax Rates Exemptions Deductions Dor

New York state income tax rate table for the 2020 - 2021 filing season has eight income tax brackets with NY tax rates of 4 45 525 59 609 641 685 and 882.

. The state has been slowly eliminating its lowest tax bracket by exempting 1000 increments every year since 2018. Corporations in the United States pay federal corporate income taxes levied at a 21 percent rate. The Mississippi tax rate and tax brackets changed from last year dropping the 3.

Like the Federal Income Tax Arizonas income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. Mississippi state income tax rate table for the 2022 - 2023 filing season has three income tax brackets with MS tax rates of 0 4 and 5 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. 2021 the states flat income tax rate was.

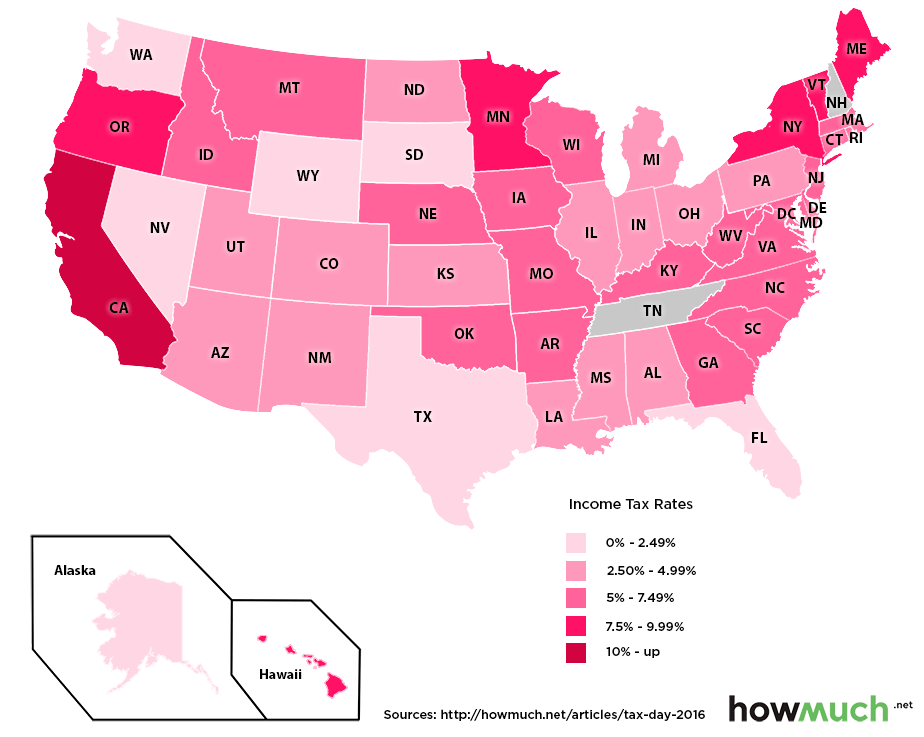

Arizona collects a state income tax at a maximum marginal tax rate of spread across tax brackets. The state supplemental income tax withholding rates currently available for 2021 are shown in the chart below. The following map shows a list of states by income tax rate for 2021.

Prior to 2022 the Pelican States top rate ranked 25th. 2020 New York tax brackets and rates for all four NY filing statuses are shown in. As of January 1 2022 Mississippi has completed the phaseout of its 3 percent individual income tax brackets.

Mississippi Income Tax Rate 2022 - 2023. Arizonas maximum marginal income tax rate is the 1st highest in the United States ranking directly. Unlike the Federal Income Tax North Carolinas state income tax does not provide couples filing jointly with expanded income tax brackets.

South Dakota Total Tax Burden. The chart also shows if the state has a flat tax rate meaning only one rate of tax applies regardless of the wages paid or alternatively the highest marginal withholding rate according to the states latest computer withholding formula. Like many states with no income tax South Dakota rakes in revenue through other forms of taxation including taxes on cigarettes and alcohol.

The state income tax rate can and will play a role in how much tax you will pay on your income. North Carolinas maximum marginal income tax rate is the 1st highest in the United States ranking directly below North. Have corporate income taxes on the books with top rates ranging from North Carolinas single rate of 25 percent to a top marginal rate of 115 percent in New Jersey.

Many states also levy taxes on corporate incomeForty-four states and DC. North Carolina collects a state income tax at a maximum marginal tax rate of spread across tax brackets. The top marginal individual income tax rate was permanently increased from 49 to 59 with the addition of a new bracket.

Tax Rates Exemptions Deductions Dor

Lowest Highest Taxed States H R Block Blog

Federal Income Tax Deadline In 2022 Smartasset

Which U S States Have The Lowest Income Taxes

Mississippi Tax Rate H R Block

State W 4 Form Detailed Withholding Forms By State Chart

How Do State And Local Individual Income Taxes Work Tax Policy Center

States With No Income Tax H R Block

Mississippi Tax Rate H R Block

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Mississippi State Tax Refund Ms State Tax Brackets Taxact Blog

State Income Tax Rates Highest Lowest 2021 Changes

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Mississippi State Taxes 2021 Income And Sales Tax Rates Bankrate

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

How Do State And Local Individual Income Taxes Work Tax Policy Center

California Tax Forms 2021 Printable State Ca 540 Form And Ca 540 Instructions

How Is Tax Liability Calculated Common Tax Questions Answered

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)